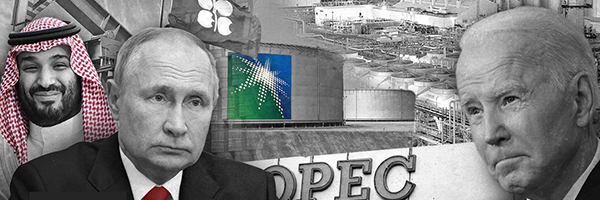

MK Bhadrakumar, The Cradle, October 11 2022 — The Biden administration’s poor dealings with oil producing countries will have major political and economic ramifications for the west.

MK Bhadrakumar, The Cradle, October 11 2022 — The Biden administration’s poor dealings with oil producing countries will have major political and economic ramifications for the west.

The old adage is that a good foreign policy is the reflection of the national policy. In this sense, a perfect storm is brewing on the foreign policy front in the US, triggered by the OPEC decision on 5 October to cut oil production by 2 million barrels a day.

On the one hand, this will drive up the gas price for the domestic consumer and on the other, will expose the US administration’s lop-sided foreign policy priorities.

At its most obvious level, OPEC’s move confirms the belief that Washington has lost its leverage with the cartel of oil-producing countries. This is being attributed to the deterioration of the US’ relations with Saudi Arabia during the presidency of Joe Biden. But, fundamentally, a contradiction has arisen between the US interests and the interests of the oil producing countries.

Petro-diplomacy

That being said, contradictions are nothing new to the geopolitics of oil: the 1970s and 1980s witnessed two major “oil crises.” One was man-made while the other was an interplay of historical forces — the Yom-Kippur War of 1973 and Iran’s Islamic Revolution of 1979. In the downstream of the former, the Arab nations weaponized oil and proclaimed an oil embargo on western nations which were perceived to have supported Israel in the war.

The result was that the price of oil rose nearly 300 percent in less than six months, crippling the world’s economy. In the US, President Richard Nixon asked petrol stations not to sell gasoline from Saturday night through until Monday morning to cope with the crisis, which affected industry more than the average consumer.

In 1979, the Iranian Revolution hit oil production rates and the world’s oil supply shrunk by 4 percent. As panic set in, demand for crude oil shot up and prices more than doubled.

Biden’s folly

The Biden administration has tempted fate by underestimating the importance of oil in modern diplomacy, and ignoring that oil will remain the dominant energy source across the world for the foreseeable future, powering everything from cars and domestic heating to huge industry titans and manufacturing plants.

Even the steady transition to green energy over time is largely dependent on the continued availability of plentiful, cheap fossil fuel. However, the Biden administration overlooked the fact that those who have oil reserves wield a huge amount of power over our oil-centered energy systems, while those who buy oil are, on the contrary, cripplingly dependent on the market and the diplomatic relations which drive it.

The western powers are far too naive to think that an energy superpower like Russia can be simply “erased” from the ecosystem. An “energy war” with Russia is therefore destined for failure.

Historically, western nations understood the imperative to maintain good diplomatic relations with oil-producing countries. But Biden threw caution into the wind by insulting Saudi Arabia – when in the run-up to the 2020 presidential elections, he vowed to make the kingdom a “pariah” state.

Despite his highly-publicized visit to Jeddah in July 2022 to mend fences, the Saudis distrust American intentions, and we are unlikely to see any improvement in US-Saudi relations under Biden’s administration.

The congruence of interests on the part of the OPEC to keep the prices high is essentially because they need the extra income for their expenditure budget and to maintain a healthy investment level in the oil industry. The International Monetary Fund (IMF) in April projected Saudi Arabia’s breakeven oil price — the oil price at which it would balance its budget — at $79.20 a barrel.

Although the Saudi government does not disclose its assumed breakeven oil price, a Reuters report suggested that a preferred price level would be around $90 to $100 a barrel for Brent crude — at which level, it won’t have a huge impact on the global economy. Of course, anything over $100 will be a windfall.

Dictating who can and can’t sell oil

Meanwhile, a “systemic” crisis is brewing. It is only natural that OPEC views with skepticism the recent moves by the US and the EU to curtail Russia’s oil exports. The west rationalizes these moves as being aimed at drastically reducing Russia’s revenues from oil exports (which translates into resilience to fight the war in Ukraine.)

The latest G7 move to put a cap on the prices at which Russia can sell its oil is taking matters to an extreme.

OPEC regards price caps as a paradigm shift, as it implicitly challenges the cartel’s assumed prerogative to ensure that global oil supply matches demand, where one of the key measures of supply-demand balance is price. Arguably, the west is de facto setting up a rival cartel of oil-consuming countries to regulate the oil market.

No doubt, the west’s move is precedent-setting — namely, to prescribe for geopolitical reasons the price at which an oil-producing country is entitled to export its oil. If it is Russia today, who is to say it will not be Saudi Arabia or Iraq tomorrow? The G7 decision – if it gets implemented – will erode OPEC’s key role regulating the global oil market.

OPEC fights back

As such, OPEC is proactively pushing back with its recent decision to cut down oil production by 2 million barrels per day and keep the oil price above $90 per barrel. OPEC estimates that Washington’s options to counter OPEC+ are limited. Unlike in the past energy history, the US does not have a single ally today inside the OPEC+ group.

Due to rising domestic demands for oil and gas, it is entirely conceivable that the US exports of both items may be curtailed. If that happens, Europe will be the worst affected. In an interview with the Financial Times last week, Belgian Prime Minister Alexander De Croo warned that as winter approaches, if energy prices are not brought down, “we are risking a massive deindustrialization of the European continent and the long-term consequences of that might actually be very deep.”

He added these chilling words: “Our populations are getting invoices which are completely insane. At some point, it will snap. I understand that people are angry . . . people don’t have the means to pay it.” De Croo was warning about the likelihood of social unrest and political turmoil in European countries.

The economic and political fallout

Without a doubt, this is a tectonic shift in geopolitics which may probably turn out to be more important than the conflict in Ukraine in the making of the multipolar world order.

This perfect storm in Biden’s foreign policy can also impact the US midterm elections in November and deliver a Republican majority in the Senate, which could set the tempo for the 2024 US presidential election.

The Kremlin’s spokesman Dmitry Peskov has said that by turning away from Russian energy, Europe has become a captive market for the US oil companies which are now making “crazy money,” but the high cost of it is draining away the competitiveness of the European economy.

“Production is collapsing. Deindustrialization is coming. All this will have very, very deplorable consequences for the European continent over probably, at least, the next 10-20 years,” Peskov said.

Incidentally, Russia stands to gain the most from OPEC+cuts. The expert opinion is that oil prices will move higher from current levels through year-end and next year. That is to say, Russia will not cut any output while the price of oil is set to rise in the coming months.

As oil prices rise, Russia will not have to cut even a barrel of its production so long as it has a big enough market after December to sell the crude now going to Europe. Again, Moscow, for its part, reiterates that it will not supply oil to countries that would join the G7 price cap. In doing so, it is matching the Biden administration’s non-market instruments.